6 Steps to an Effective Financial Statement Analysis

If you need to prepare financial statements for a 3rd party, such as a lender, sometimes the third celebration might request that the monetary statements be prepared by an expert accountant or licensed public accounting professional. Likewise called a statement of financial position, a balance sheet is a financial photo of your service at an offered date in time.

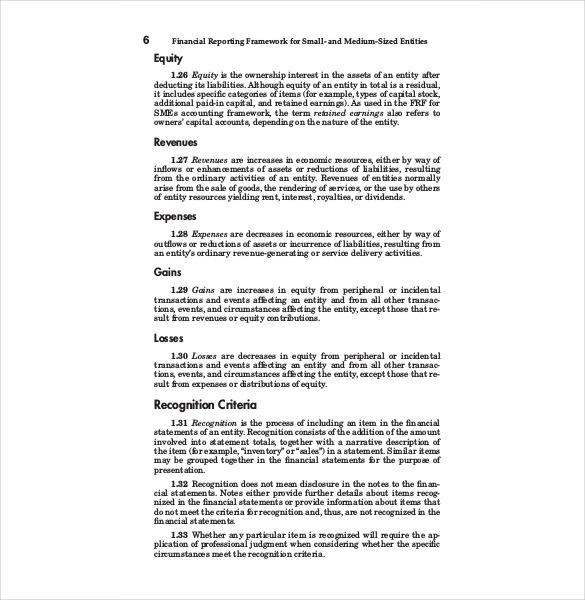

The accounting equation (properties = liabilities + owner’s equity) is the basis for the balance sheet. The balance sheet is prepared after all adjusting entries are made in the basic journal, all journal entries have been published to the basic journal, the basic journal accounts have actually been footed to come to the duration end totals, and an adjusted trial balance is prepared from the general journal amounts.

An ability to comprehend the financial health of a company is among the most crucial skills for striving investors, business owners, and supervisors to develop. Equipped with this knowledge, investors can much better recognize appealing opportunities while avoiding excessive threat, and specialists of all levels can make more tactical company choices.

While accountants and financing professionals are trained to check out and comprehend these documents, many company professionals are not. The impact is an obfuscation of critical info. If you’re brand-new to the world of monetary declarations, financial report dropbox paper this guide can help you read and comprehend the info contained in them. Free E-Book: A Supervisor’s Guide to Financing & Accounting Gain access to your free e-book today.

The value of these files depends on the story they inform when reviewed together. 1. How to Read a Balance Sheet A conveys the “book value” of a business. It allows you to see what resources it has readily available and how they were financed since a particular date. It reveals its assets, liabilities, and owners’ equity (essentially, what it owes, owns, and the quantity invested by shareholders).

12 Things You Need to Know About Financial Statements

refer to money a business owes to a debtor, such as outstanding payroll costs, financial obligation payments, lease and energy, bonds payable, and taxes. describes the net worth of a company. It’s the amount of cash that would be left if all properties were offered and all liabilities paid. This cash belongs to the investors, financial report dropbox paper who might be private owners or public investors.

This post will teach you more about how to read a balance sheet. 2. How to Read an Earnings Declaration An, likewise called a profit and loss (P&L) declaration, sums up the cumulative impact of earnings, gain, expense, and loss transactions for a provided period. The file is often shared as part of quarterly and yearly reports, and shows monetary trends, company activities (profits and expenses), and contrasts over set durations.

3. How to Check Out a Cash Circulation Declaration The function of a is to provide a detailed image of what happened to a service’s money during a specified period of time, known as the accounting period. It demonstrates an organization’s ability to run in the short and long term, based on just how much money is streaming into and out of it.

Operating activities detail cash flow that’s created once the company delivers its routine products or services, and consists of both income and expenses. Investing activity is capital from buying or offering assetsusually in the form of physical property, such as property or vehicles, and non-physical home, like patentsusing free cash, not financial obligation.

It is very important to note there’s a distinction in between capital and earnings. While cash flow describes the cash that’s streaming into and out of a company, earnings refers to what remains after all of a business’s expenses have been subtracted from its earnings. Both are essential numbers to know.

Financial statement preparation

Preferably, money from operating income must regularly surpass earnings, because a positive cash flow talks to a business’s financial stability and capability to grow its operations. However, having positive cash flow does not always imply a business pays, which is why you likewise require to evaluate balance sheets and income statements.

more about save paper

4. How to Read an Annual Report An is a publication that public corporations are needed to publish annually to investors to explain their functional and Forum.Greelancer.Com financial conditions. Yearly reports typically incorporate editorial and storytelling in the kind of images, infographics, and a letter from the CEO to describe corporate activities, benchmarks, and achievements.

Beyond the editorial, a yearly report summarizes monetary information and femina.I360.pk includes a company’s income statement, balance sheet, and money flow statement. It likewise offers market insights, management’s conversation and analysis (MD&A), accounting policies, and extra financier details. In addition to a yearly report, the United States Securities and financial report dropbox paper Exchange Commission (SEC) needs public business to produce a longer, more in-depth 10-K report, which notifies investors of an organization’s monetary status prior to they purchase or sell shares.

You can likewise discover comprehensive discussions of operations for the year, and a full analysis of the industry and market. Both a yearly and 10-K report can help you understand the financial health, status, and objectives of a business. While the annual report uses something of a narrative aspect, consisting of management’s vision for the company, the 10-K report strengthens and expands upon that story with more detail.

A Vital Skill Reviewing and comprehending these financial files can provide you with valuable insights about a business, including: Its debts and ability to repay them Profits and/or losses for a provided quarter or year Whether earnings has actually increased or decreased compared to comparable previous accounting periods The level of financial investment required to preserve or grow the service Operational expenses, financial report dropbox paper specifically compared to the earnings generated from those expenses Accountants, financial report dropbox paper financiers, shareholders, and company leadership need to be keenly knowledgeable about the financial report dropbox paper health of a company, but workers can likewise gain from comprehending balance sheets, earnings statements, capital statements, Lam Research and yearly reports.

How to Use Balance and Income Statements for Your Business

Structure your monetary literacy and abilities doesn’t need to be hard.

Leave A Comment

You must be logged in to post a comment.