QuickBooks Financial Statements: A Complete Guide

Let’s start by discussing what the financial area of a company strategy is not. Realize that the monetary section is not the very same as accounting. Many individuals get puzzled about this since the monetary projections that you consist of– profit and loss, balance sheet, and capital– look comparable to accounting statements your business produces.

Business planning or forecasting is a forward-looking view, starting today and entering into the future.”You don’t do financials in a service plan the very same way you determine the information in your accounting reports,” states Tim Berry, president and creator of Palo Alto Software, who blogs at and is writing a book, The Plan-As-You-Go Organization Plan.

It’s a sophisticated educated guess.”What this means, says Berry, is that you sum up and aggregate more than you might with accounting, which deals more in detail. “You don’t need to envision all future property purchases with theoretical dates and theoretical devaluation schedules to estimate future devaluation,” he states. “You can simply think based upon past results.

You’re going to need it if you are seeking financial report dropbox paper investment from endeavor capitalists, angel financiers, financial report dropbox paper or even smart member of the family. They are going to desire to see numbers that say your business will grow– and quickly– which there is an exit method for them on the horizon, during which they can earn a profit.

But the most important reason to compile this monetary projection is for your own advantage, so you comprehend how you forecast your organization will do. “This is an ongoing, living document. It must be a guide to running your business,” Pinson says. “And at any specific time you feel you need financing or financing, then you are prepared to go with your documents.”If there is a general rule when completing the numbers in the monetary section of your company plan, it’s this: Be practical.

3 Financial Statements to Measure a Company’s Strength

“They actually aren’t reputable.” Berry, who acts as an angel financier with the Willamette Angel Conference, brasafer.com.Br states that while a startling development trajectory is something that potential investors would love to see, it’s most frequently not a credible growth forecast. “Everybody desires to get associated with the next Google or Twitter, however every strategy seems to have this hockey stick forecast,” he says.

One method, Berry says, is to break the figures into parts, by sales channel or target market segment, and supply sensible price quotes for sales and earnings. “It’s not precisely information, because you’re still guessing the future. However if you break the guess into component guesses and take a look at each one individually, it in some way feels better,” Berry states.

And you probably won’t present it in the last document in the exact same series you put together the figures and files. Berry says that it’s normal to begin in one location and leap backward and forward. For example, what you see in the cash-flow plan might suggest returning to change estimates for sales and green bay paper expenses.

Start with a sales projection. Establish a spreadsheet projecting your sales throughout three years. Set up various sections for green bay paper different lines of sales and columns for each month for the first year and green bay paper either on a regular monthly or quarterly basis for the second and 3rd years.

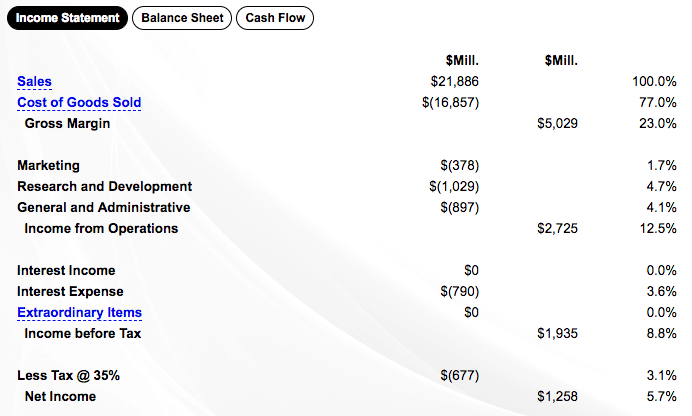

“Why do you want cost of sales in a sales forecast? Because you want to compute gross margin. Gross margin is sales less cost of sales, and it’s an useful number for comparing to various basic market ratios.” If it’s a new product or a brand-new line of work, you need to make an informed guess.

What is financial reporting?

Create an expenditures spending plan. You’re going to need to comprehend how much it’s going to cost you to in fact make the sales you have forecast. Berry likes to separate between set costs (i. e., lease and payroll) and variable costs (i. e., many advertising and advertising expenses), due to the fact that it’s an advantage for a service to understand.

read this blog article save paper

“Most of your variable expenses remain in those direct costs that belong in your sales projection, however there are likewise some variable costs, like ads and rebates and such.” Once again, this is a forecast, not accounting, and you’re going to have to estimate things like interest and taxes. Berry suggests you choose basic mathematics.

And after that multiply your approximated financial report dropbox paper obligations balance times an estimated rate of interest to estimate interest. Establish a cash-flow declaration. This is the declaration that shows physical dollars moving in and out of business. “Capital is king,” Pinson states. You base this partly on your sales forecasts, balance sheet products, and other presumptions.

If you are starting a brand-new service and do not have these historical monetary declarations, you start by forecasting a cash-flow declaration broken down into 12 months. Pinson says that it’s important to comprehend when compiling this cash-flow projection that you need to select a practical ratio for the number of of your invoices will be paid in cash, one month, 60 days, 90 days and so on.

Some service preparation software application programs will have these formulas developed in to assist you make these projections. Income projections. This is your pro forma profit and loss statement, detailing projections for your service for the coming three years. Utilize the numbers that you put in your sales forecast, green bay paper expense projections, and cash circulation declaration.

Finance 1, The Income Statement in the Annual Report

“Gross margin, less expenditures, interest, and taxes, is net earnings.” Deal with assets and green bay paper liabilities. You also require a predicted balance sheet. You have to deal with properties and liabilities that aren’t in the earnings and loss declaration and job the net worth of your business at the end of the .

Leave A Comment

You must be logged in to post a comment.