A Beginner’s Guide to the 4 Financial Statements

Secret Takeaways Financial statements are a fundamental part of running a rewarding, financially-sound company. Financial statements make up three individual items, all of which help both internal and external stakeholders make excellent decisions relating to the business. A monetary strategy is equally as crucial, and helps company owner chart their courses for the future based upon their present and lam research historical financial positions, resources and contingency plans.

Financial statements are very important due to the fact that: Report a minecraf Issue They create a documented “proof” for a business’s monetary activities. They sum up essential monetary accounting info about the company. They offer both internal and external stakeholders an accurate image of the organization’s existing monetary scenario. Financial declarations are likewise utilized by lending institutions to determine an entity’s level of risk.

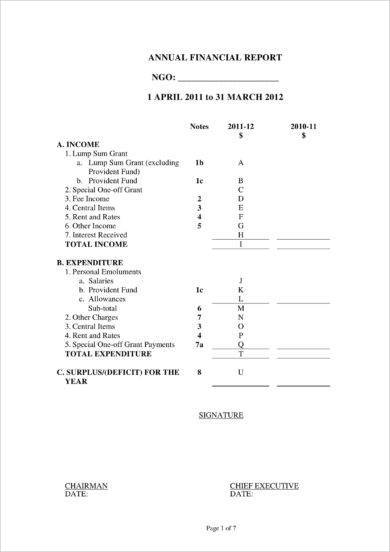

They likewise offer accounting professionals with the data they require to be able to finish a business’s tax returns and other required paperwork. Individually, the 3 main financial statements for lam research little businesses each serve a various purpose. The income statement, for instance, reveals whether a company is generating a revenue, while the balance sheet exposes the current status of business since the date noted on that document (vs.

Finally, a business’s money invoices and cash disbursements can be found on its money flow declaration. Video: Comprehending Financial Statements What Should Be Included in a Financial Statement? Company owner and their accountants use income declarations, balance sheets and capital statements to examine a business’s financial performance. The earnings statement consists of all of a business’s incomes, expense of items (or expense of sales for services business) sold and other expenditures across a specified period (e.

What Is Financial Reporting?

Listed vertically, lam research the entries on this statement typically appear in this order: revenue, expenditures, and net earnings The balance sheet includes all of a company’s properties, liabilities and investor equity. In most circumstances, these numbers are represented in two various columns. Lastly, the money circulation statement sums up all of a business’s operating, funding and financial investment inflows and outflows, including but not restricted to changes in the value of stock, receivable and payable and report a minecraf issue long-lasting debt.

Utilizing the monetary statements outlined in this post, you’ll develop a monetary plan that not only covers the company’s progress and present status but also consider future development. This is a workout you can do for yourself, prospective financiers consisting of investor, or lam research any other service stakeholder. At minimum, the plan must consist of a sales forecast for the next three to 4 years, a spending plan for overhead and overhead, a cash circulation declaration and a forecast of awaited net earnings gradually.

Integrated, lam research these key information points will assist you chart a course for the future by 1) evaluating the business’s existing financial status and 2) forecasting a course forward based on historic performance. The plan will help you manage cash circulation, get ready for possible cash shortages (e. g., due to industry or economic slumps) and set achievable goals for Save paper the next 3 to 5 years.

5 Actions to Writing a Financial Prepare For my Organization Here are the five actions you’ll wish to take when composing a financial plan for your company: Do you wish to expand? Do you want to add brand-new customer sections? Do you need more devices? Do you require funding? The responses to these concerns will help you kick off the monetary strategy writing procedure.

37+ Sample Financial Report Templates

They require monthly forecasts. Calculate your expected earnings based on monthly forecasts for sales and expenses for items like labor, supplies and overhead, and then include the costs for the objectives you determined in the previous action. Utilize these monetary declarations to develop a precise, current image of your company’s monetary health.

more about green bay paper

Most of the times, you will utilize either the existing ratio or fast ratio. Current properties/ Present liabilities (Money + Money equivalents + Existing Accounts Receivable)/ Present liabilities From these estimations, you can figure out whether your business has the funds available to cover its short-term obligations. You’ll desire to have enough emergency situation sources of cash before your business deals with challenges that warrant utilizing them.

Like anything in life, the secret is to not wait up until it’s too late to secure these fund sources and make sure that they exist when you need them.

Tracking of essential reports consists of the following activities: Review: Taking a look at 2 crucial management reports for perceived anomalies and errors of compound, based upon the reviewer’s experience and knowledge of the unit’s operations. This activity is at a summarized or overview level. More in-depth information just needs to be examined for abnormalities.

Financial statement

Anomalies should be determined and descriptions documented and saved. Recommendation: Attestation by reviewer that he/she reviewed the details, investigated abnormalities, guaranteed the correction of mistakes, and can supply sensible guarantee of the propriety (efficiency, precision, and credibility) of the information. Review and acknowledgment activities may be delegated and carried out at a lower organization level, but the Department Finance Leader need to review the designated key reports and offer recommendation for the department level to the Controller’s Workplace.

All evaluations should be done a minimum of quarterly. Recommendation of the evaluations is needed on a quarterly basis by the end of the month following the previous quarter close for Q1 to Q3. Q4 acknowledgment is due 2 weeks after actual information is loaded into the reporting systems. Recommendations of review of the essential financial report dropbox paper reports occur with submission to the Controller’s Workplace by means of Berkeley Box.

This review includes analyzing outcomes through variation analysis of incomes, operating transfers, and expenses by comparing the real activity to spending plan and previous year actual outcomes. The Cal, Preparation Reporting GL Summary Month-to-month Comparative Actuals report was designed to supply activity at this summed up level. The reviewer needs to: Download and save an electronic copy of the report.

Leave A Comment

You must be logged in to post a comment.